gavin6942

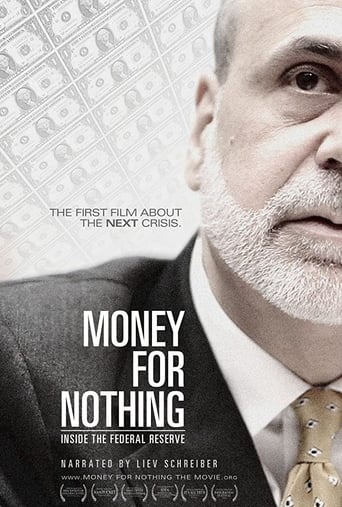

Nearly 100 years after its creation, the power of the U.S. Federal Reserve has never been greater. Markets and governments around the world hold their breath in anticipation of the Fed Chairman's every word. Yet the average person knows very little about the most powerful - and least understood - financial institution on earth.This film covers everything from the Great Depression up through Bretton Woods (and its repeal in 1971) and on through the crisis of 2007-2008. We get Greenspan's connection to Ayn Rand and learn a few technical terms like "quantitative easing".This is a great primer for anyone who knows absolutely nothing about the Federal Reserve. And, frankly, that happens to be most of us. Even those who do know something will probably learn more. How odd that the engine fueling our economy (maybe even the entire global economy) is not something many people could even explain.

amarbdmi

the best Documentary on the topic are the money master and Money As Debt,i assume the producer At least have seen them but they haven't.for the part where money was created,Borrowing is the major way ,when someone Borrow from bank where does the money come from,does it came from your Account? i don't think so . if this was the case you will notice. does it come from bank's money? i don't think so ,they need it for the Bonus. in fact it's money from nowhere created by the bank, it's a Obligation that bank has to pay the Borrower in exchange for the the Promise that the Borrower will pay back more, yes it's that twisted, for instance the Borrower spend the money and the money usually end up in some Account in the bank, bank's Assets(everyone's saving plus the Borrower's Promise) and its liability (Obligation to pay Depositor and the Borrower) both increase ,and as long as the bank's Assets is greater than its liability ,the came can continue forever.as for the fed which is a Private bank with its own share holders just as the Central Bank of the United Kingdom, it is responsible for the Creation of U.S. dollar. the Borrower is US government. as for Greenspan who has been Praised a lot by the movie (at least by the people they Interview) is not the Reason for the U.S. economy to be Prosperity in 1990. the true Reason is that sucker like china gone dollar-Fever , they pumping low-cost merchandise into US in exchange for green paper which keep the Cost of Living low while Destroy the manufacturing industry of US thus free the whole Country to work in Financial sector which Attract suckers all over the world to Invest in its Stock market. lots of Big shot Appear in the movie, but it didn't help, because they only help Themselvesin the end they try to Summary that the wallstreet did what they did because fed made the money easy and the fed did what they did because they are simply unware of the Consequence of their Behavior, which is so not true, anyone with a basic Knowledge of Economy knows what would happen if the Leverage was too higha better choose of Documentary on Financial crisis would be inside job and meltdown by cbc

oatmeel73

End the Fed is a 2009 book by Congressman Ron Paul of Texas. The book debuted at number six on the New York Times Best Seller list[1] and advocates the abolition of the United States Federal Reserve System. SummaryPaul argues that "in the post-meltdown world, it is irresponsible, ineffective, and ultimately useless to have a serious economic debate without considering and challenging the role of the Federal Reserve."[2]In End the Fed, Ron Paul draws on American history, economics, and anecdotes from his own political life to argue that the Fed is both corrupt and unconstitutional. He states that the Federal Reserve System is inflating currency today at nearly a Weimar or Zimbabwe level, which Paul asserts is a practice that threatens to put the United States into an inflationary depression where the US dollar, which is the reserve currency of the world, would suffer severe devaluation.A major theme throughout the work also revolves around the idea of inflation as a hidden tax making warfare much easier to wage. Because people will reject the notion of increasing direct taxes, inflation is then used to help service the overwhelming debts incurred through warfare. In turn the purchasing power of the masses is diminished, yet most people are unaware. Under Ron Paul's theory, this diminution has the biggest impact on low income individuals since it is a regressive tax. Paul argues that the CPI presently does not include food and energy, yet the these items are the items on which the majority of poor peoples' income is spent.He further maintains that most people are not aware that the Fed – created (he asserts) by the Morgans and Rockefellers at a private club off the coast of Georgia[3] – is actually working against their own personal interests. Instead of protecting the people, Paul contends that the Fed now serves as a cartel where the name of the game is bailout -- or otherwise known as privatized profits but socialized losses.Paul also draws on what he argues are historical links between the creation of central banks and war, explaining how inflation and devaluations have been used as war financing tools in the past by many governments from monarchies to democracies.

jeff-michael-johnson

A must-see film for investors looking to understand the recent Boom & Bust cycles produced by the Federal Reserve. More importantly, a must-see film for investors looking to dodge the next BIG bubble. The producer does an excellent job illustrating the history of the Federal Reserve and its original role in the economy. Most impressive, is the quality of the cast interviewed during the film. Members of the Federal Reserve, IMF, Bank of International Settlements, and famous economists to name only a few examples. The credibility of these individuals gives the information more weight than the average documentary. Finally, the film goes on to explain how the Federal Reserve has become something that was not originally intended during its creation, a political instrument that impacts every one of us. Never has it been more important to understand this concept and how it applies to the next big bubble being created as we speak.